Key Measures to Consider When Buying Multifamily Properties

January 22 2025

If you’re thinking of investing in a multifamily property, we have information about what numbers to consider if you proceed.

As a quick background, it’s helpful to understand the two primary types of multifamily properties, because they can be of residential use for more than a single dwelling unit. In most cases, 2-to-4-unit properties are included in a single bucket, and 5+ unit properties are all included in a second bucket.

The practical reason for this is that the structure of these mortgages is potentially different: 2–4-unit properties may qualify for conventional 30-year mortgage terms, whereas 5+ units will likely require a term of 5-10 years.

Capitalization Rate (Cap Rate)

Cap rate is one of the most common financial measures discussed in commercial real estate. By definition, the cap rate is annual NOI (operating income minus operating expenses, not including any principal and interest payments) divided by the market value of the property. So, for example, a property that has $100,000 in NOI and is worth $1,000,000, the cap rate would be 10%.

For investors, understanding cap rates in the market for comparable properties will allow you to do the reverse of the above calculation in order to determine an estimated value of a property. As a matter of practice, if you determine that the market cap rate for an apartment building in an area is 7.5%, you divide the NOI of $100,000 (for example) by the 7.5% cap rate and determine the property value to be $1,333,333.

While this is probably the most commonly used valuation metric, it has shortcomings, because not all parties (buyers, sellers, brokers, appraisers, lenders) will calculate the same NOI. Even if they have the same cap rate the value can be somewhat different. Additionally, depending on how many units the property has, it may not be reflective of how it is valued. Cap rates tend to be more valuable for larger properties that don’t have owner-occupants looking to purchase them.

Gross Rent Multiplier (GRM):

Gross rent multiplier is similar to cap rate because it looks at the relationship between income and value in a market. However, unlike cap rate, GRM only looks at the gross rents that a property could or does generate without consideration being given to expenses. This tends to work well more broadly than cap rate, as it can be applied to 2-4 units and 5+ units alike.

As an example, if the market GRM for 4-unit properties is 12x gross, then a property with 4 units rented for an average of $1,500 per month per unit would bring in $72,000 per year. If you apply a 12x GRM to that $72,000, an investor might determine that the property is worth $864,000.

Debt Service Coverage Ratio (DSCR):

Debt service coverage ratios are probably most important when considering your mortgage payments and also very important to commercial real estate lenders. While DSCR doesn’t help determine an estimated market value, it does help guide investment decisions based on the properties’ ability to generate positive cash flow.

A DSCR is based on annual NOI (again, income minus operating expenses) divided by the annual total of your principal and interest payments. So, if you have $100,000 in NOI divided by $80,000 in annual principal and interest payments, you DSCR would be 1.25x ($100,000/$80,000 = 1.25x) and the owner would estimate excess cash flow of $20,000 per year.

Lenders will have different requirements for this number, so it is something to pay attention to.

Other Metrics

There are other financial factors that people pay attention to, such as price per unit or price per square foot. These are fairly straightforward, but based on comparable sales you can determine the market price of a unit or a square foot of property and apply that to the property that you’re trying to estimate value for. This might not be ideal, because units could have different finishes and different numbers of bedrooms, so it’s important to think through these factors and make adjustments to how they are applied.

Then there’s the 1% rule, which means if you’re looking to buy a property, the monthly rent should be at least 1% of the price being paid. While some investors use this, as is the case with all the previous metrics, there are limitations. For example, this does not give consideration to property taxes, so the 1% rule may be more attractive in a lower tax state than it would be in a higher tax state.

So What’s The Right Choice?

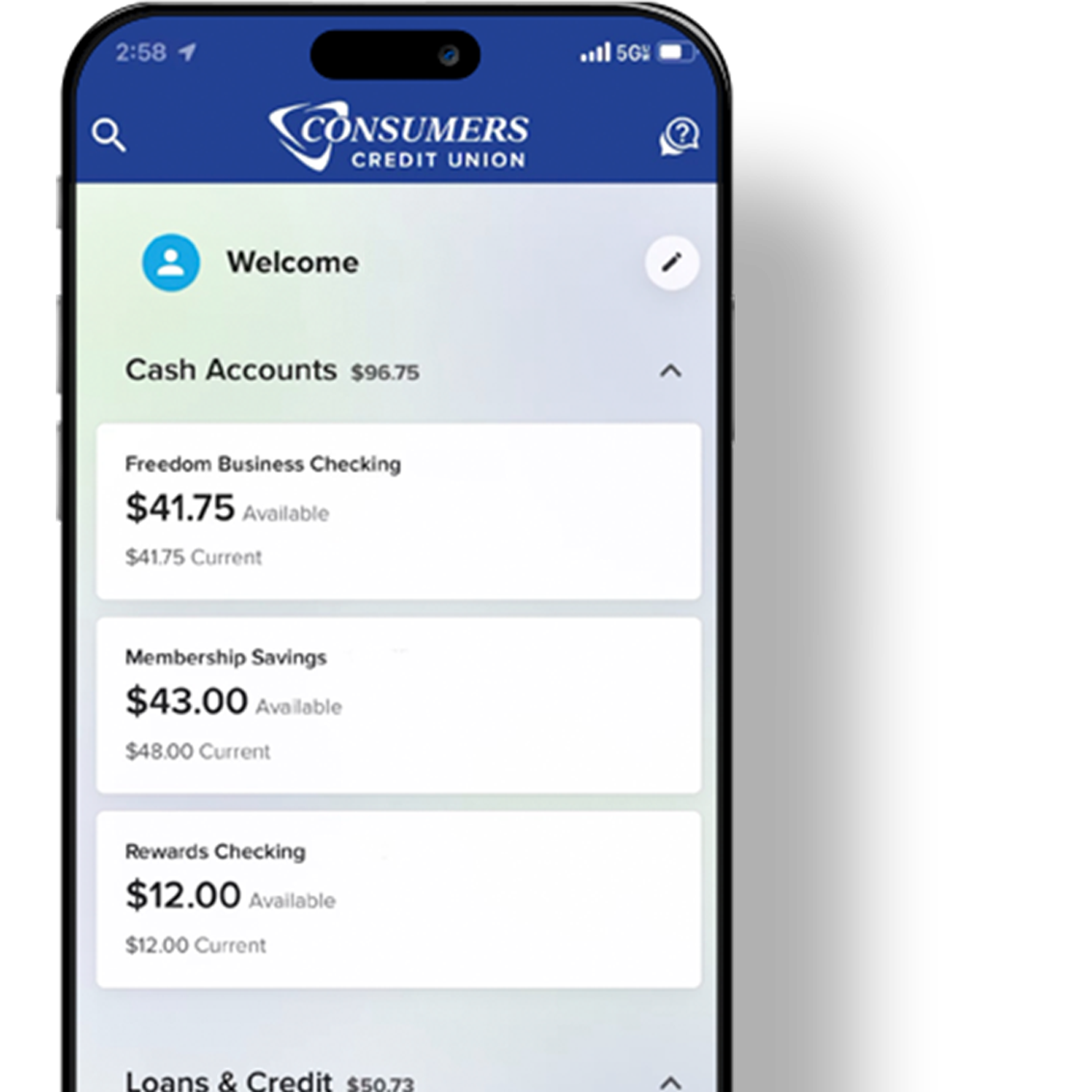

At Consumers Credit Union, our Commercial Lending Team specializes in commercial real estate financing, with a particular focus on multifamily. As The People In Your CornerTM, we’re here to help members who are thinking about investing in multifamily or apartment buildings. You can start with the basics here and/or find out more about us and how we can help you here.