It pays to be a member

with people in your corner.

At Consumers Credit Union, you're not just a customer, you're a member. You get access to lower loan rates, higher-yield savings, and personalized offers—all designed with your best interest in mind.

Membership - Banking - Credit - Lending

Get more for your money.

With personalized, easy-access checking and savings options that pay higher dividends.

The right card is right this way.

Whether you're looking for lower rates or better rewards, we have the card that's right for you.

The Road to Smart Auto Loan Savings Starts Here.

With CCU, you can score your best car loan rate, new or used, and hit the road with confidence.

Rates that make your dream come true.

Find the best mortgage for your next move.

Start planning for tomorrow, today.

We are able to help you plan for your financial future. From IRAs to college planning, we can help you reach your financial goals.

GreenPath Financial Wellness

Consumers Credit Union has partnered with GreenPath™ to offer free debt counseling and financial consulting to our members. Get on the path to financial wellness today.

TruStage Home, Auto & Life Insurance Program

Protect your home, auto, & family with TruStage™ Insurance from Consumers Credit Union. We offer plans that are dedicated to ensuring your investments are secure. Learn more about the insurance options offered.

Why CCU is the best financial choice you can make.

What is a Credit Union?

About Us

Online & In Your Corner

Smart Choice for Your Career

CCU is not just a Great Place to Work® certified organization—for your career, we’re the smart financial choice too. As a not-for-profit credit union, our mission is rooted in helping people achieve financial success, and that includes our employees. We offer competitive pay, robust retirement plans with generous employer contributions, performance-based incentives, and financial wellness programs designed to support your goals. Our team members also enjoy the benefits of working for a financially strong, growing organization that reinvests in its people and its communities. When you join CCU, you're choosing a workplace that values your financial future as much as you do. Learn More.

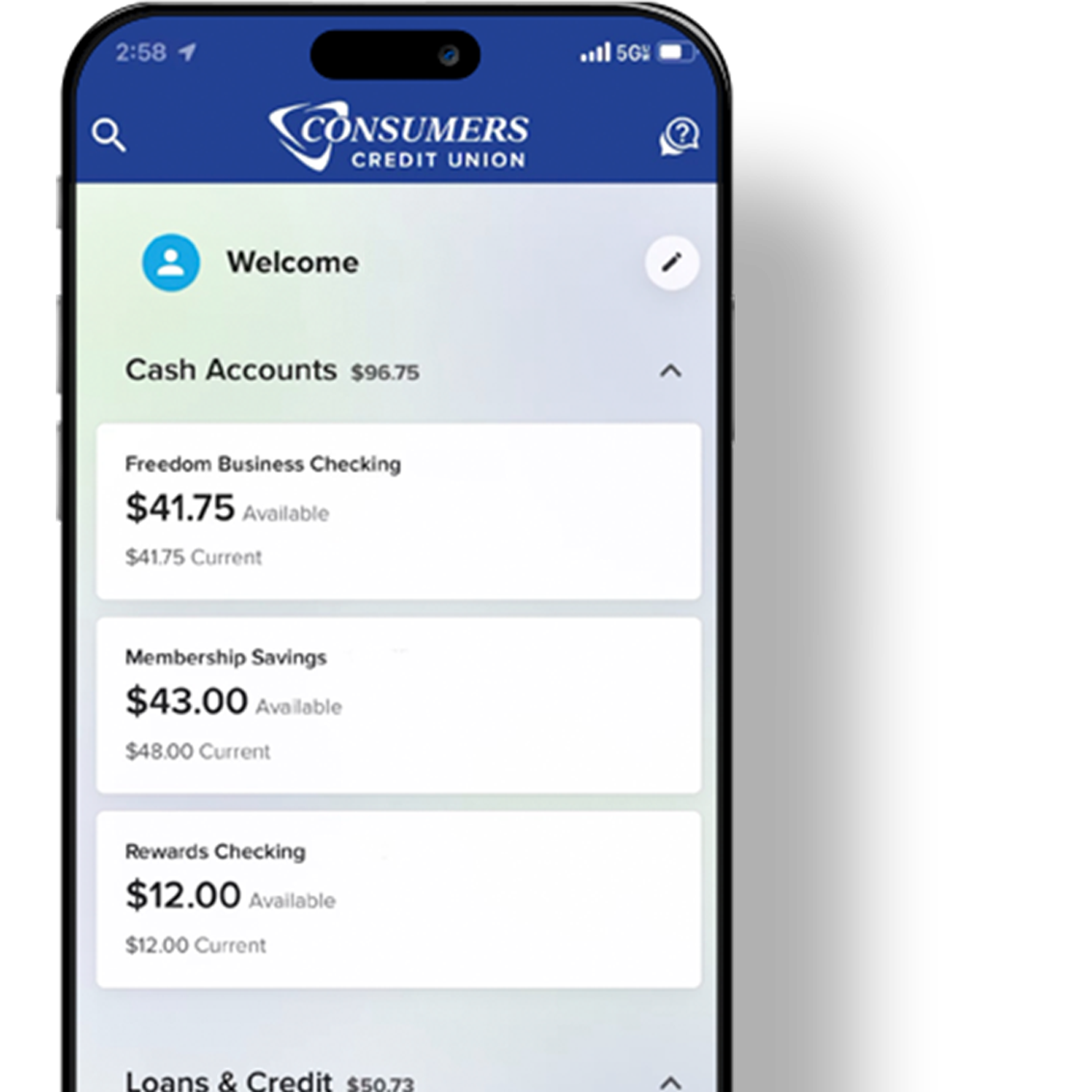

Bank anytime, anywhere.

Download the CCU mobile app for fast, secure access to your accounts, easy transfers, mobile check deposits and more.

*APY = Annual Percentage Yield. APR=Annual Percentage Rate. Please read complete terms and conditions.

^You could earn a $200 bonus reward!+

+Open a new CCU Visa Credit Card account, get 0% intro APR* on purchases and balance transfers for 12 months. Terms and conditions apply. After that, your APR* will be 13.20% to 27.49%, based on your creditworthiness. After $1,000 in net new purchases within the first 90 days of account opening.